Table of contents

Definition

- Market trends are essentially the general movements that the prices of shares, goods, cryptocurrencies or other assets follow over a given period. Understanding different market trends is important for investors, traders and financial analysts, as it enables them to better anticipate future movements and make appropriate decisions. Indeed, by observing these trends, market players can determine whether it makes sense to buy, sell or hold their assets. Finally, tracking market trends provides relevant information on price fluctuations, indicating the direction in which values are moving.

The three main faces of the market

There are three main configurations: uptrend, downtrend and range.

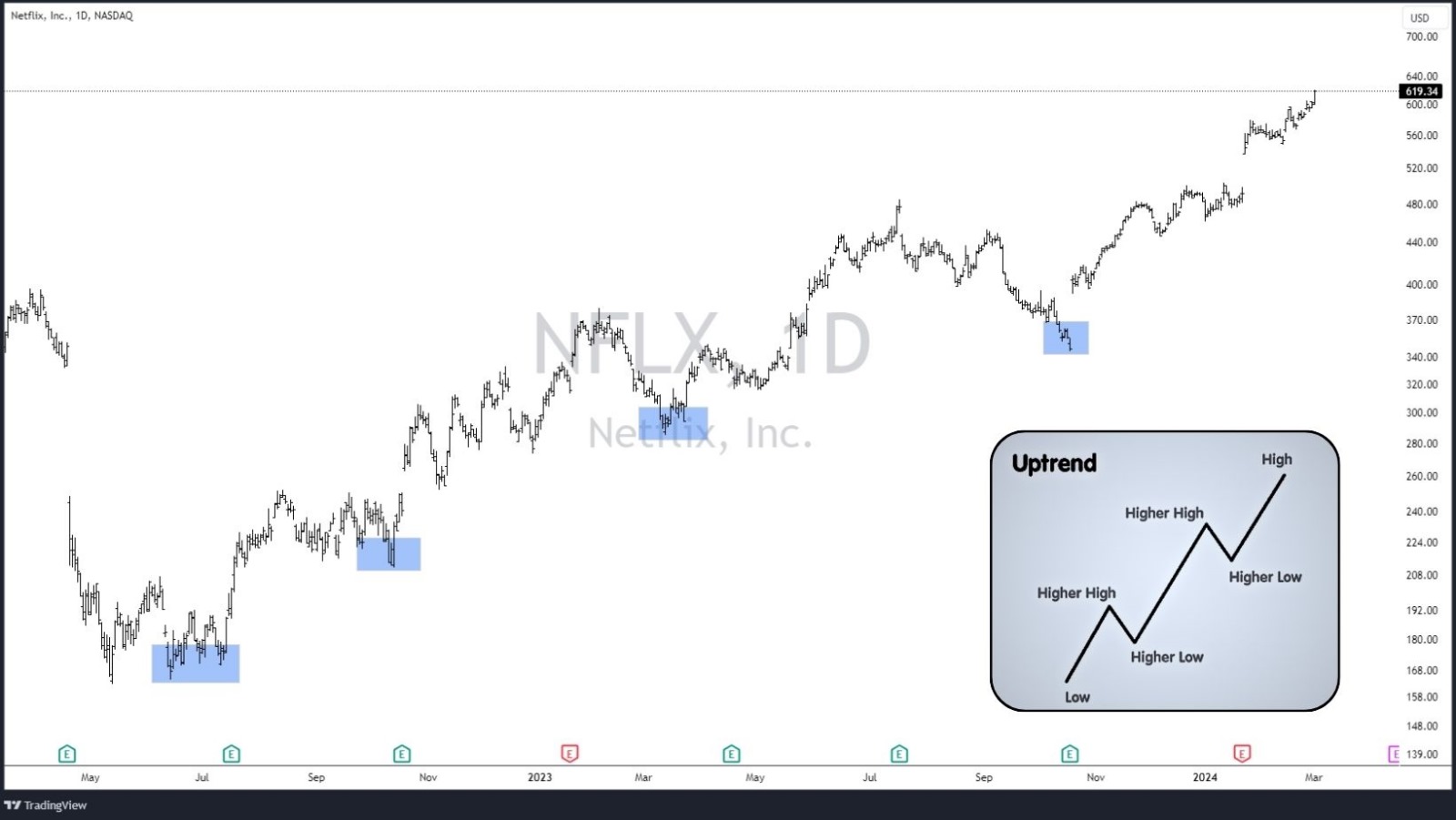

1. Uptrend market

- An uptrend occurs when asset prices rise gradually over a given period. This trend can be identified by a series of higher peaks and troughs over time. It is often associated with positive investor sentiment, robust economic growth and widespread market optimism. In a clear bull market, correction phases, marked by temporary declines, are less pronounced in amplitude than impulse phases, when prices experience significant increases. This distinction is crucial for anticipating potential reversals: if the correction is more pronounced than the previous impulse phase, it may call into question the current uptrend. In such circumstances, traders should reconsider their buy positions and carefully assess the viability of the current uptrend.

2. Downtrend market

- In a downtrend, asset prices generally experience a gradual decline over time. This trend is characterized by a series of higher highs and lower lows, signaling a downward market dynamic. Bear markets are often associated with negative investor sentiment, periods of economic slowdown and a general climate of pessimism. In a bear market, high points become lower and lower, and so do lows. In this context, rebounds are often less significant in amplitude than phases of decline, which is an essential characteristic of a bear market. In an established trend, movements aligned with the dominant trend are generally the most pronounced. As with an uptrend, a trend reversal can be anticipated. This presupposes that the price recovery is of greater amplitude than the last phase of decline observed.

Range or no-trend market

- In a range, also known as a no-trend or trendless market, asset prices stagnate within a relatively narrow price range, with no clear directional movement either up or down. This phase, identified by a sideways market with no clear direction, is characterized by price fluctuations that remain within a defined range of highs and lows, indicating a lack of conviction on the part of investors or traders and thus leading to a period of consolidation. In other words, buyers and sellers evaluate each other, without a clear consensus emerging.

Strategies for market trends

Traders aim to identify impulses within bullish or bearish trends. They seek to position themselves early in these movements and avoid unnecessary risks when the market is unpredictable. Adaptability to changing market conditions is a key quality of good traders.

Fluctuations differ according to bullish, bearish or range trends. In an uptrend or downtrend, traders can buy or sell at high or low levels and continue to buy or sell at even higher or lower levels, as long as the uptrend or downtrend continues.

However, in a range market, traders should rather buy low and sell high, identifying resistances and supports, and be ready to act quickly according to market conditions.

- Generally speaking, it has been found that in these periods, many impatient traders make mistakes by acting impulsively, buying resistances and selling supports, thereby losing opportunities and capital. Conversely, in established trends, they tend to take profits too soon. These mistakes, due to psychological bias, are often the result of inexperience and poor emotional management.

Conclusion

Firstly, the study of different market configurations, whether bullish, bearish or range-bound, reveals different and changing market dynamics that present challenges and opportunities for investors and traders.

Secondly, according to Wilder's analysis, markets don't always follow a clear trend, but move in trend only about a third of the time, leaving the remaining two-thirds marked by a lack of clear direction. This observation underlines the importance of not succumbing to momentum bias, where investors are tempted to blindly follow recent market movements.

It's also important to recognize that any trend is ultimately ephemeral and subject to reversal. So it's wise not to buy on resistance without clear confirmation, but to be prepared to buy on support. Patience and the ability to wait for the right moment are important qualities for any trader or investor.

Finally, in a trending market, movements aligned with the dominant direction are generally the most powerful, which underlines the importance of following the established trend while remaining vigilant for reversal signals.

Disclaimer: this is not financial advice. Satolix.io website aims to inform readers about Blockchain, cryptocurrencies and Web3. Any type of investment involves risk. Please do your due diligence and research the articles and projects presented on the site. Be responsible and don't invest more than your goals or financial means allow. In this regard, please read our page: Warning about virtual currencies.

Some articles on the site contain affiliate links, and using them to register on the site enables the site to grow through the collection of commissions. By doing so, you also make yourself eligible for a welcome bonus such as a voucher or reduced fees, for example.

Trading

Trading 2024-03-02

2024-03-02