Table of contents

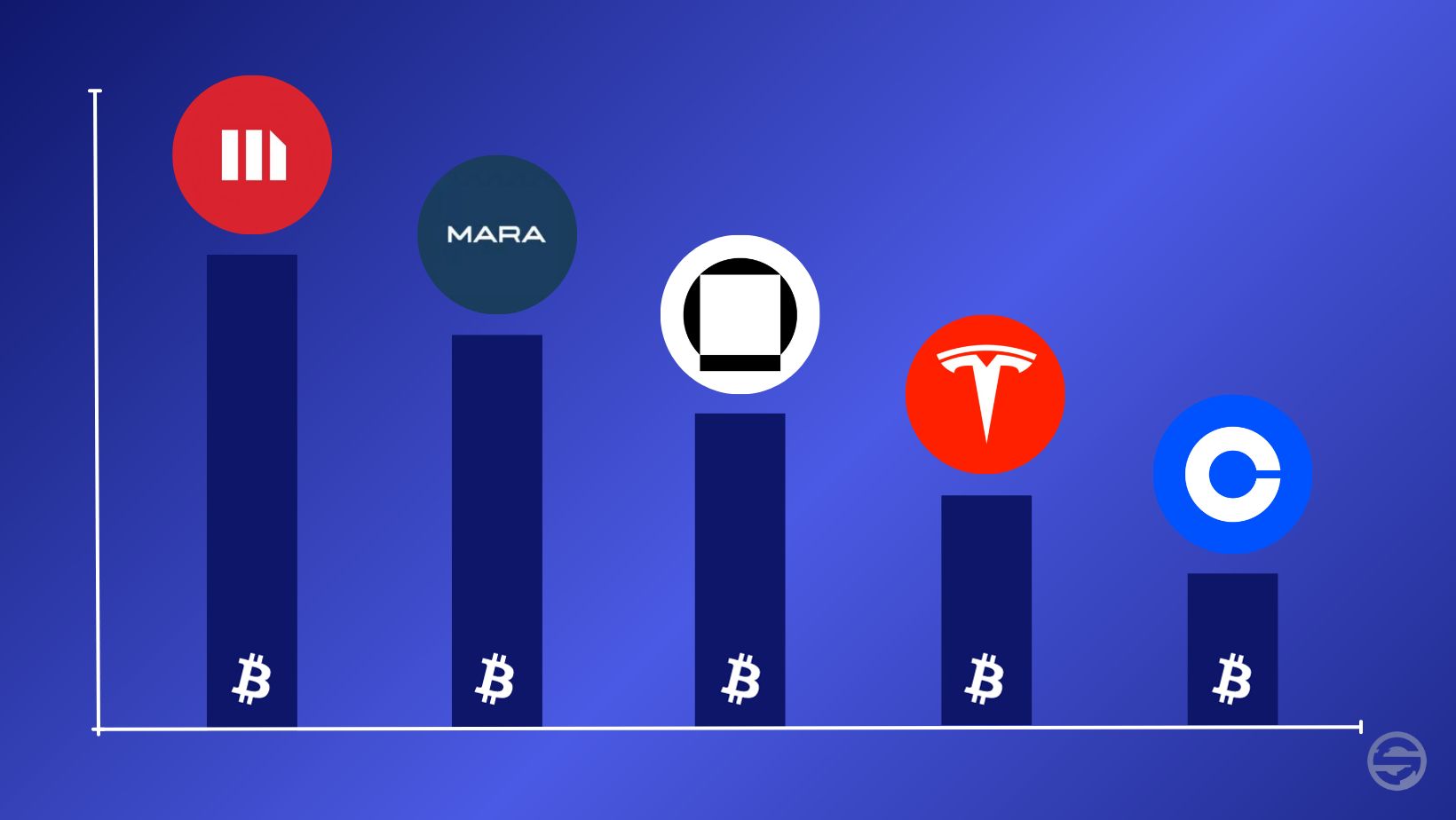

Top 10 listed companies

According to Coingecko's data on publicly traded companies around the world that buy Bitcoin as part of their treasury, here are the 10 public companies with the most Bitcoin, ranked in descending order of holdings:

#1 MicroStrategy

MicroStrategy (MSTR) is an American company specializing in business intelligence and data analysis. Founded in 1989 by Michael J. Saylor, it offers software solutions designed to help companies make data-driven decisions.

MicroStrategy Inc. currently holds 158,245 BTC, with an initial total value of $4,680,000,000, or 0.754% of the Bitcoin supply. Their current market value is $4,349,666,532. MicroStrategy's average purchase price for BTC is approximately $29.556 per Bitcoin.

#2 Marathon Digital Holdings

Marathon Digital Holdings, Inc (MARA) is a digital asset technology company specializing in cryptocurrency mining and focused on the blockchain ecosystem. The company was founded on February 23, 2010 and is headquartered in Las Vegas, USA. Fred Thiel has been CEO since April 26, 2021.

Marathon Digital Holdings today holds 13,286 BTC, initially acquired for $189,087,000, representing 0.063% of the Bitcoin offering. The current value of their Bitcoin portfolio is $365,775,966. The average BTC purchase by Marathon Digital Holdings is approximately $14.247 per Bitcoin.

#3 Galaxy Digital Holdings

Galaxy Digital Holdings (GLXY) is a financial services company specializing in cryptocurrencies and blockchain technology. It was founded by Michael Novogratz, a former hedge fund manager, and operates in various segments of the digital asset industry, including trading, asset management, investment banking and mining.

- Galaxy Digital Holdings currently owns 12,545 BTC, equivalent to 0.06% of the Bitcoin supply. Although data on the initial purchase cost is not available, the current value of their Bitcoin portfolio is estimated at $345,375,545.

#4 Tesla, Inc.

Tesla, Inc (TSLA) is an American company specializing in electric vehicles, solar energy and energy storage solutions. Founded in 2003 by Elon Musk, JB Straubel, Martin Eberhard, Marc Tarpenning and Ian Wright, Tesla has played a major role in the popularization of electric cars.

Tesla, Inc. currently has 10,500 BTC, initially acquired for $336,000,000, representing 0.05% of the Bitcoin supply. The current value of their Bitcoin portfolio is $289,074,788. The average BTC purchase by Tesla, Inc. is approximately $32,000 per Bitcoin.

#5 Coinbase Global, Inc.

Coinbase Global (COIN) is a leading online digital currency wallet and cryptocurrency exchange platform. Founded in May 2012 by Brian Armstrong and Fred Ehrsam, Coinbase has become one of the world's leading cryptocurrency exchanges.

Coinbase Global, Inc. currently stores 9,182 BTC, with an initial total value of $207,783,800, representing 0.044% of the Bitcoin supply. The current value of their Bitcoin portfolio is $252,789,020. Coinbase Global, Inc.'s average BTC purchase is approximately $22.609 per Bitcoin.

#6 Hut 8 Mining Corp

Hut 8 Mining Corp (HUT) is a Canadian technology company convinced by blockchain and Web 3.0 technologies and specialized in cryptocurrency mining, particularly Bitcoin.

Hut 8 Mining Corp currently owns 8,289 BTC, representing 0.039% of Bitcoins. Information regarding the initial purchase cost is not available, however, the current value of their Bitcoin portfolio is estimated at $228,203,897.

#7 Block Inc.

Block Inc (SQ) is an American company specializing in mobile payments and electronic financial transactions. The company is headquartered in San Francisco. Founded by Jack Dorsey and Jim McKelvey in February 2009, Block Inc. has transformed itself, expanding its offering to a variety of financial services and products.

Block Inc. currently holds 8,027 BTC, with an initial total value of $220,000,000. This holding represents 0.038% of the Bitcoin offering. The current value of their Bitcoin portfolio is $220,990,793. Block Inc.'s average BTC purchase is approximately $27.416 per Bitcoin.

#8 Riot Plateforms, Inc.

Riot Platforms, Inc (RIOT) is a Bitcoin mining company that actively supports the Bitcoin blockchain with a substantial and rapidly growing presence in the United States.

- RIOT Platforms, Inc. currently has 7,265 BTC, or 0.035% of the Bitcoin supply. Despite the absence of initial purchase cost data, the current value of their Bitcoin portfolio is estimated at $200,012,223.

#9 Hive Blockchain

Hive Blockchain (HIVE) is a Canadian company specializing in blockchain and cryptocurrency technologies. Its main focus is on mining cryptocurrencies such as Bitcoin and Ethereum.

Hive Blockchain currently owns 2,332 BTC, equivalent to 0.011% of the Bitcoin supply. Although initial purchase cost data is not available, the current value of their Bitcoin portfolio is estimated at $64,202,134.

#10 Nexon Co Ltd

Nexon Co Ltd (3659) is a South Korean company specializing in the creation of video games. Founded in Seoul in 1994, the company is renowned for developing popular games such as Combat Arms and Counter-Strike Online. The company is headquartered in Tokyo, Japan.

Nexon Co Ltd currently holds 1,717 BTC, originally acquired for $99,974,042. This holding represents 0.008% of the Bitcoin supply. The current value of their Bitcoin portfolio is $47,270,611. The average Bitcoin purchase by NEXON Co Ltd is approximately $58.277.

Conclusion

Firstly, it's important to note that these companies' Bitcoin holdings may change over time, depending on their investment strategies and business activities. Secondly, this study by Coingecko offers a relevant insight into the crypto market and its growing integration into the traditional economy worldwide. Furthermore, this data helps to boost investor confidence by revealing the movements of important players in the market. In addition, this report can be used as a useful indicator, as it reflects some of the adoption of cryptocurrencies in the business world. Finally, this information can serve as a model and encourage other companies to consider Bitcoin as a viable store of value.

Finally, analyzing which companies are adopting Bitcoin as a more or less significant part of their cash flow is a solid indicator of the changing financial landscape in our societies.

Bitcoin

Bitcoin 2023-10-05

2023-10-05