Table of contents

The human brain is a fascinating and powerful tool. It plays an important role in our day-to-day decision-making. This is all the more true when it comes to investing. A field in which money is central to our decision-making. And when the notion of money comes into play, there are many psychological biases, often emotional and cognitive, which alter our ways of processing information, our judgments or prejudices, and have a significant impact on decision-making. Cognitive and emotional biases are terms used in psychology to describe errors of thought or judgment to which individuals are subject. Although they are generally studied separately, there are interactions between these different types of bias.

When it comes to trading or investing, a field in which money plays a crucial role, these different biases quickly tend to take up space, leading us to make mistakes. As a trader or investor, it's essential to be aware of these various biases and to understand their impact, so as to manage them as effectively as possible. Neglecting them will result in irrational trading or investing, and more often than not in losses.

In this article, we'll distinguish between emotional bias and cognitive bias. We will then discuss and analyze the most common biases encountered in trading and investing.

Emotional bias vs. cognitive bias

1. Emotional bias

Emotional biases are psychological phenomena related to emotions. These biases are characterized by an alteration in understanding and decision-making due to the influence of emotional factors.

Emotional bias is described in psychology as an emotional reaction that is out of place in a given situation, and can interfere with decision-making. It can be influenced by endogenous factors linked to the individual himself/herself, but also his/her personality traits, beliefs, values, past experiences, etc. These are influences that come from within the individual. It can also be influenced by exogenous factors that come from the environment, social interactions, situations in which a person finds him/herself, the group effect, social norms, the media, social influences or pressures, etc. These are influences that come from outside the individual, and which are not necessarily linked to the individual. These are influences that come from outside the person.

These different influences, both endogenous and exogenous, can interact and combine to influence emotional biases and play a role in the perception, interpretation, evaluation and processing of information, as well as in decision-making.

Finally, emotions can influence decision-making by prioritizing emotion over reasoning.

2. Cognitive bias

Cognitive biases are psychological phenomena that refer to errors in the processing of information that occur in our cognitive processes, i.e., the set of mental processes that refer to the knowledge function (language, reasoning, memory, perception, decision-making, attention, intelligence and problem-solving). It is a deviation in the cognitive processing of information that has an impact on logical and rational thinking in relation to reality. These biases may be related to our attention, memory, reasoning or other aspects of our cognitive functioning. These biases can be influenced by factors such as cognitive simplification or pre-existing thought patterns.

Cognitive bias leads us to attach different importance to similar facts. It can also be detected when logical errors appear in a person's reasoning or judgment.

Finally, cognitive bias can influence the decision-making process in an irrational way, leading to negative consequences.

3. Conclusion

Finally, it is essential to be aware of psychological biases, whether emotional or cognitive, and to recognize their cross-influence. On the one hand, emotions can affect our cognitive processes and give rise to cognitive biases. On the other hand, cognitive biases can also influence our emotions and lead to emotional biases.

Faced with these psychological biases, which can have a direct impact on our decision-making process, it is necessary to take them into account and manage them in the best possible way in order to process information objectively and make decisions rationally.

The most common psychological biases in trading and investing

- Psychological biases are forms of thinking that get in the way of logical or rational thinking, and tend to be systematically used in a variety of situations, including trading and investing. There are many psychological biases that distract us from thinking logically and objectively, and have a negative impact on our decision-making. In this section, we'll look at the psychological biases most frequently encountered by a trader or investor on the financial markets.

1. Overconfidence bias

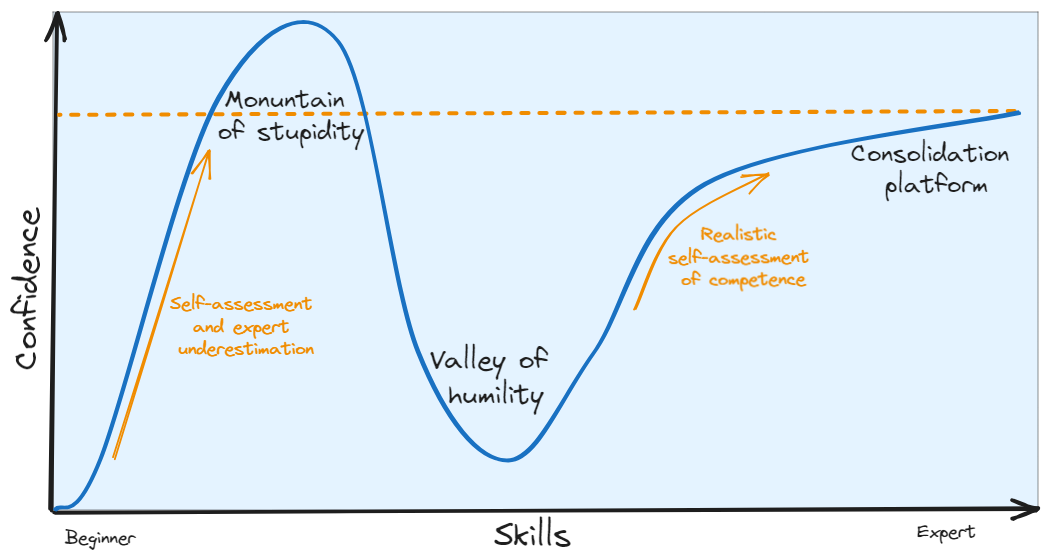

- Overconfidence bias, also known as the Dunning-Kruger effect, is a common cognitive bias in financial markets. It is a bias in which those less qualified in a sector may overestimate their knowledge and skills. This bias was highlighted by two American researchers, Dunning and Kruger. According to them, this bias appears in certain people who have difficulty recognizing their incompetence and correctly assessing their abilities. With regard to the financial markets, some people believe they are capable of predicting the future of the financial markets, whereas the latter are, by nature, unpredictable.

This graph, by Arjuna Filips, shows the learning curve for a skill in relation to self-assessment in that skill.

People affected by this bias tend to invest excessively in assets without prior research and analysis, and without considering the risks to which they are exposing themselves. Overconfidence bias can have negative repercussions in that it can lead people to make irrational or hasty decisions, to fail to seek further or additional information, and to ignore fundamental or technical warnings.

The most common example in the financial markets is that of a trader or investor who has made high capital gains on a past trade or investment, either by luck or because market conditions were favorable for a sharp rise, and who will tend to amplify an overconfidence in his abilities. This overconfidence will lead him to predict the future success of trades or investments, only to come up against a difficult reality most of the time, when the market doesn't go in the direction initially foreseen when he took the position.

2. Loss aversion bias

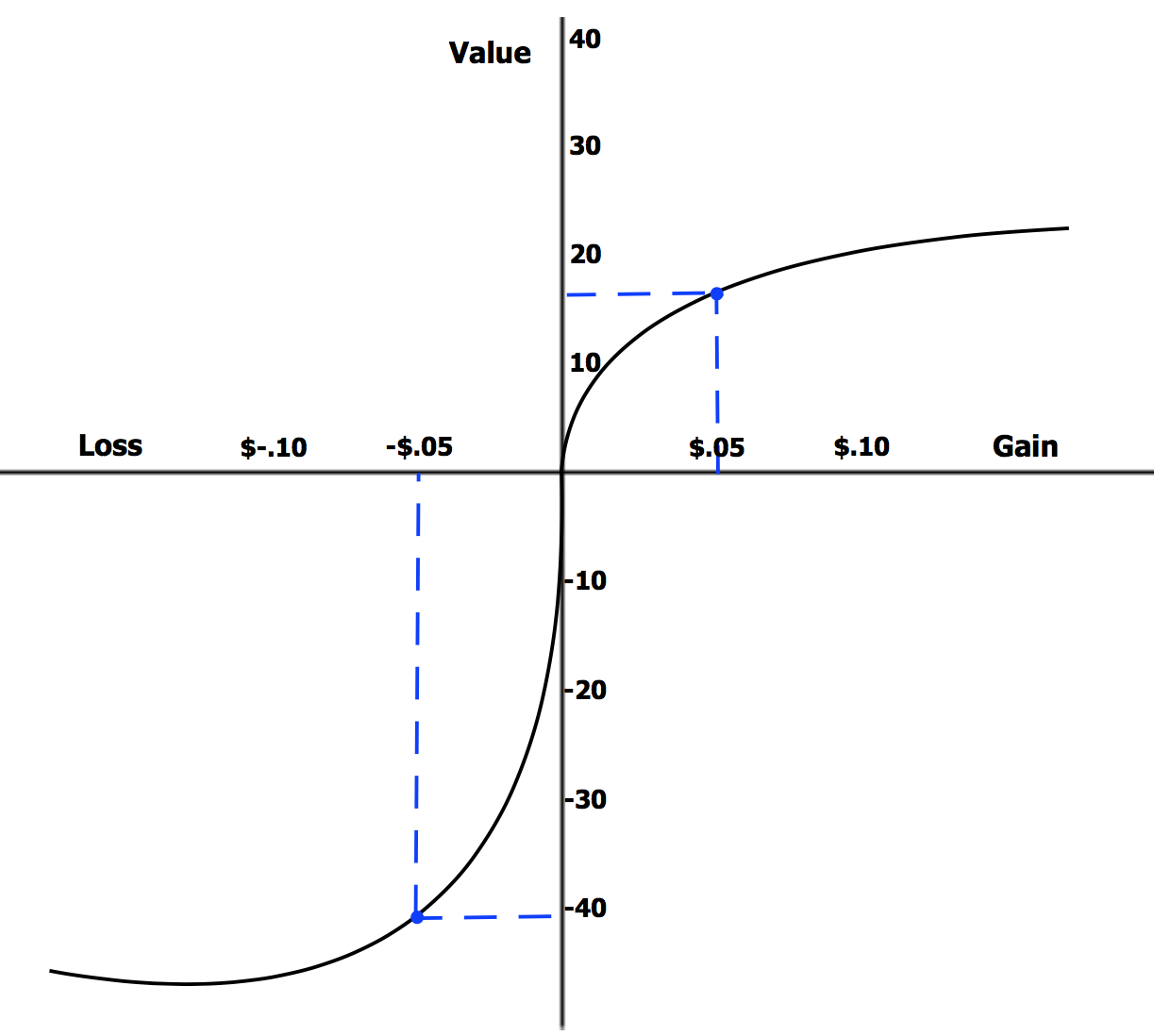

- Overconfidence bias, also known as the Dunning-Kruger effect, is a common cognitive bias in financial markets. It is a bias in which those less qualified in a sector may overestimate their knowledge and skills. This bias was highlighted by two American researchers, Dunning and Kruger. According to them, this bias appears in certain people who have difficulty recognizing their incompetence and correctly assessing their abilities. With regard to the financial markets, some people believe they are capable of predicting the future of the financial markets, whereas the latter are, by nature, unpredictable.

This graph by Lauren Rosenberger illustrates loss aversion: the perceived value of gain and loss versus the strict numerical value of gain and loss: a $0.05 loss is perceived as a much greater loss of utility than the increase in utility of a $0.05 gain.

In general, in order to comfort themselves, loss averse individuals will tend to convince themselves that this is a difficult time for the asset in question, and that they are confident that the price will eventually rise again.

A number of studies have shown that an individual who develops loss aversion will under-perform his or her financial portfolio, due to the lack of rationality in relation to the true interests of financial players.

To illustrate loss aversion bias, let's take the example of an investor who has invested $1,000 in a stock market asset. A few weeks pass, during which the price fluctuates. The investor's asset is now worth $800, an unrealized loss of $200. In the absence of a sound investment strategy, the investor is faced with a decision: sell the asset, realize a loss of $200, and ultimately recover $800, or hold on to the asset in the hope that its value will rise in the weeks ahead. This loss-averse investor will tend to hold on to the asset instead of realizing a $200 loss. This decision stems from the fact that the emotional pain associated with a $200 loss is felt to be more intense than the potential pleasure associated with a gain of the same amount.

Another case of loss aversion, well known in the financial markets, lies in a trader's willingness, for example, to sell an asset that has risen slightly in value for fear of incurring a future loss if his asset starts to move in the opposite direction, even though it has the potential to rise further.

Ultimately, the result is that, in the financial markets, traders or investors are more inclined to hold on to an asset that is losing and continuing to lose value over time, rather than sell it. Conversely, these same players are more inclined to quickly cut a position following a slight rise, rather than holding it and profiting from the whole of a favorable movement.

3. Confirmation bias

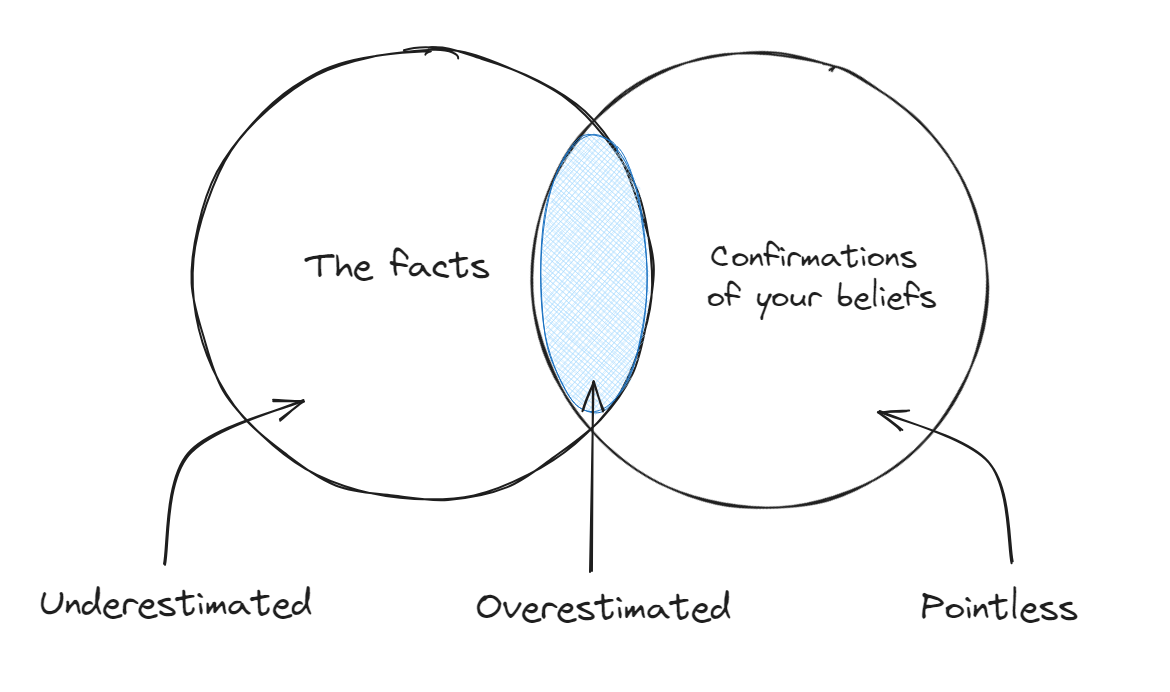

- Confirmation bias occurs when a person favors information that confirms their preconceived ideas, and gives less importance to information that runs counter to their ideas. In other words, a person affected by this bias will find it difficult to change his or her mind. This bias occurs when a person selectively gathers elements or memorized information and interprets them in a biased way.

Confirmation bias, in which the affective takes precedence over the rational, contributes to the development of overconfidence in personal beliefs, and helps to maintain or reinforce these beliefs in the face of information or evidence to the contrary.

In the case of a trader or investor, confirmation bias has the effect of seeking out and interpreting information that confirms one's idea or outlook, while minimizing or ignoring information that might contradict one's point of view. Most of the time, this type of behavior leads to biased decisions when taking positions on the financial markets.

Let's take the example of an investor who has invested a large part of his portfolio in the skyrocketing artificial intelligence sector. Everyone is talking about it - the media, financial experts, influencers and so on. The investor is confident of making a sound investment decision. However, the artificial intelligence market is showing signs of slowing down due to strict regulations. Despite this, the investor maintains his strong position in this market. He is convinced that the artificial intelligence sector has a future, and that the market will develop and expand further. However, the market continues to show signs of weakness.

At this point, the investor needs to reassure himself about his big bet. Confirmation bias will lead the investor to look for information that confirms his strong conviction, such as price predictions issued by economic experts, analysts' reports that recommend buying stocks in this sector, or news that highlights its performance. He will ignore warning signals, whether fundamental or technical, and will reject information contrary to his initial belief, indicating that the artificial intelligence market could face difficulties in the future.

In the end, instead of basing his decisions on facts and making rational decisions, the investor may find himself overexposed to this market, even as signs of a turnaround become increasingly evident. All this can lead to potentially large losses, as his decisions are based on emotion rather than rational fact.

4. Anchoring bias

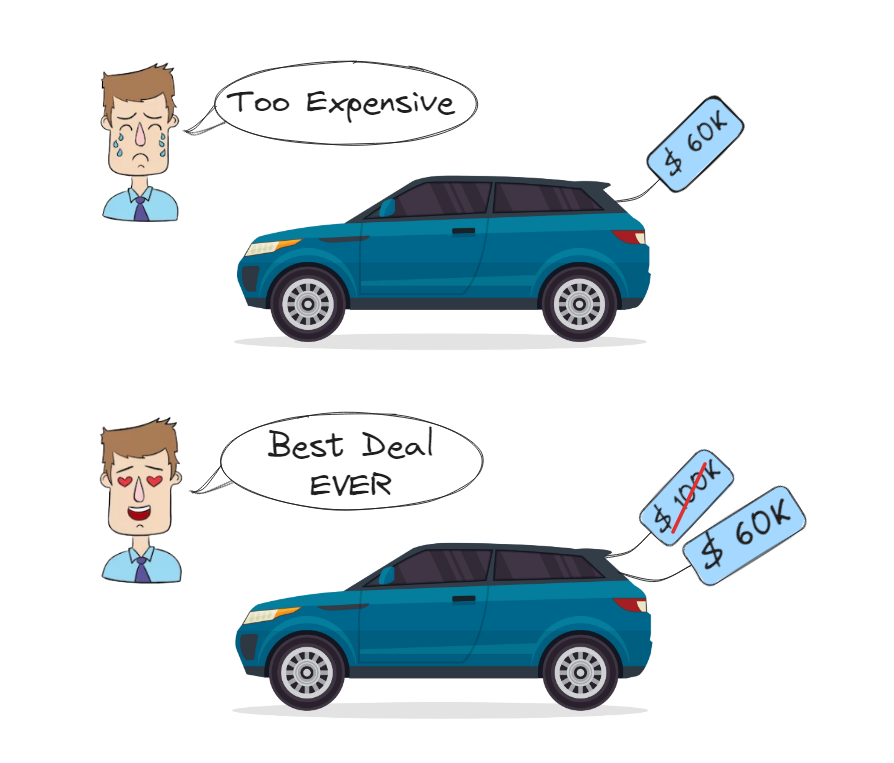

- Anchoring bias is a cognitive bias theorized by cognitive psychologists and behavioral finance specialists Tversky and Kahneman. This bias arises when our decision-making is influenced by an initial reference element, value or information, known as an "anchor". In other words, the anchoring bias manifests itself when a person can't get rid of a first impression, giving more importance to an initial piece of information received when making a decision. This implies that the person can no longer take new information into account.

The first piece of information received, also known as an anchor point, has the effect of distorting an individual's judgment. Numerous studies have shown that it is difficult to detach oneself from an anchor point, even when the individual is aware of it. According to these studies, anchoring bias is more likely to occur in the case of a quantified anchor, such as a quantity or a price. In concrete terms, when an anchor is presented - a price, for example - our brain tends to latch onto the first price given and use it as a reference point, even if this anchor is not rational or justified. As a result, when it comes to investing, anchoring bias has a potentially powerful impact on our minds, and has the capacity to influence our judgment when making decisions.

To give an example, let's say an investor has owned shares in a company for some time. In recent months, the share price has fluctuated between $50 and $60. Suddenly, the share price climbs to $80 following an announcement of the company's exceptional quarterly results. At a conference organized by the same company, a renowned financial expert was invited to make price predictions. He argued convincingly that the share price was underpriced and should continue to rise, reaching a justified price of $100. The investor has renewed optimism and is anchored by the new price of $80 per share. What's more, following the financial expert's speech, he decides to strengthen his position at this new price. In his opinion, the machine is up and running, and the company's future performance should be good. The price rise will continue and earnings will increase.

However, last quarter's exceptional results were due to the signing of a one-off contract, a largely temporary factor. On the other hand, the long-term prospects of the company in which he holds his shares may be less favorable than the financial expert and the recent rise in the share price had suggested. Then comes the announcement of the next quarter's results, and unfortunately, they're not as good as expected. The company was unable to sign any new long-term contracts, and the share price quickly plummeted to $40. The investor, still anchored on the $80 price and the financial expert's forecasts, prevents himself from taking the recent unfavorable results into account. He hopes for a rapid rise in the price and decides not to sell his shares, thereby minimizing his losses.

This example highlights how anchoring bias has the potential to influence investors' decisions. It trains them to retain information about a past price, a sudden price action or a price forecast, without re-evaluating their perception of a stock's value in the light of recent information.

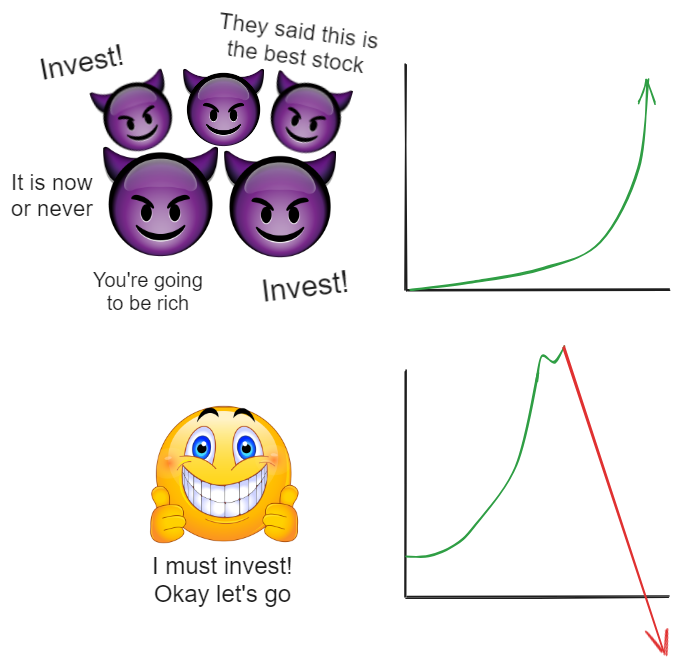

5. Conformity bias

- Conformity bias, also known as conformism, refers to the attitude of conforming to social expectations, either of an individual or of a group. Conformity bias implies not deviating from the norm and not acting differently from what is socially expected. This bias, rooted in our societies, is well known in the financial markets, and very often has a consequent impact on trading and investment decision-making. This bias occurs when a person tends to follow the opinions or behaviors of a majority, rather than thinking for themselves, regardless of external noise. This affective bias can have disastrous financial consequences, as decision-making is often impulsive and based on crowd opinion.

Conformity bias is powerful in the financial markets. Indeed, it's not uncommon for a trader or investor to be fully aware of this bias, believing that a group's ideas or behavior may not be relevant or rational. Despite this, the trader or investor chooses to adopt the ideas and behaviors of a group, for fear of missing an opportunity for example. Experiments on the conformism effect, such as those by Asch, a pioneer of social psychology, have shown that individuals are often prepared to give up their own judgment to conform to the opinion of a majority, even when that opinion is manifestly false.

A common example of this bias in the financial markets is the infatuation with certain popular or "trendy" assets. The media, and social networks in particular, play an important role in conformity. The latter can influence traders' and investors' decision-making, by highlighting a particular company or asset as the opportunity of the decade. In the absence of judgment, and out of fear of missing this opportunity, players in the financial markets are tempted to buy assets without undertaking in-depth research or analysis. The history of the financial markets has shown, time and again, that when the crowd wants to own an asset because it is heavily promoted by the media and social networks, the asset in question is very often overvalued. Once the position has been opened by the trader or investor, a market correction occurs, either because the majority realize that the fundamentals of the asset do not justify such a valuation, or because a significant profit is taken by the traders or investors who have returned to the asset instead.

This phenomenon was particularly noticeable during the dot-com bubble of the early 2000s, when many technology companies experienced rapid growth in the preceding years, only to face a consequent market correction due to particularly high valuations.

Conclusion

Psychological biases have a powerful impact on our decision-making. However, biases are part of human nature. We all have biases. The key is to be aware of them, and to put strategies in place to make relevant, thoughtful and rational decisions. Awareness of our psychological biases, skill development, critical thinking, questioning, our willingness to actively manage our biases, remaining open to opposing views, seeking out different information and perspectives, are always in which we can help improve our ability to make justified, objective decisions.

What's more, as human beings, it's impossible to fully manage our emotions and be constantly rational. It is therefore very difficult, if not impossible, to completely eliminate psychological biases. These biases are part of our brain and our cognitive and emotional functioning. Taking these biases into account, not allowing ourselves to be overwhelmed by our emotions or by distortions in our judgement, and trying to minimize them when making decisions is already a great achievement.

Finally, when it comes to trading and investing, getting informed, training, practicing and gaining experience will be your best assets. Recognizing these biases, adopting an approach based on facts rather than emotional reactions, and not being too hard on yourself, will make you a better player on the financial markets.

- Sources :

- - D. Kahneman , Système1 / Système2 : Les deux vitesses de la pensée', Flammarion, coll. Essais, Paris 2012 ;

- - R. Macmullen, ’Feelings in History’, CA: Regina Books, Claremont, 2003 ;

- - Comment vos émotions impactent vos investissements', sur lendopolis.com, consulté le 12.07.23 ;

- - 'La surconfiance comme premier facteur d'échec', sur facteurs-humains.fr, consulté le 12.07.23 ;

- - J. Kruger & D. Dunning, 'Unskilled and Unaware of It : How Difficulties in Recognizing One's Own Incompetence Lead to Inflated Self-Assessments', Journal of Personality and Social Psychology, vol. 77, no 6, 1999 ;

- - J. Pérignon, ’Effet Dunning Kruger : comment le détecter et gérer pour une vie harmonieuse en entreprise’, sur hubspot.fr, consulté le 13.07.23 ;

- - D. Kahneman & A. Tversky, ’Prospect Theory: An Analysis of Decision under Risk’, Econometrica 47, 1979 ;

- - D. Kahneman & A. Tversky, ’Loss Aversion in Riskless Choice: A Reference Dependent Model’, Quarterly Journal of Economics 106, 1991 ;

- - C. R. Mynatt, M. E. Doherty & R. D. Tweney, ’Consequences of confirmation and disconfirmation in a simulated research environment’, vol. 30, Quarterly Journal of Experimental Psychology, 1978 ;

- - A. Tversky, ’Judgement under Uncertainty : Heurisitics and Biases’, Science, 1974 ;

- - B. Bathelot, 'Prix d'ancrage', Défintions marketing, 2018 ;

- - 'L'effet d'ancrage', Bien-être, 2019, sur noovomoi.ca, consulté le 14.07.23 ;

- - R. B. Cialdini & N. J. Goldstein, "Social Influence: Compliance and Conformity". Annual Review of Psychology 55, 2004 ;

- - S. E. Asch, ’Opinions and Social Pressure’, Scientific American 193, 1955 ;

- - ’Biais psychologiques dans le trading et comment les éviter’, sur broker-forex.fr, consulté le 14.07.23.

Disclaimer : This is not financial advice. The purpose of the site is to inform readers. Any type of investment involves risk. Do your due diligence and do your own research on the projects featured on the site. Act as a good father and do not invest more than your objectives or financial means allow you. In this regard, read our page: Warning about virtual currencies.

Some articles on the site contain affiliate links, and using them to register from the site allows the development of the site by collecting commissions. By doing so, you also make yourself eligible for a welcome bonus such as a voucher or fee reduction, for example.

Investment

Investment 2023-08-16

2023-08-16